Top of Mind. Happy Sunday! A big welcome to the new subscribers who discovered the newsletter through Revue’s unexpected but exciting feature. Big Tech this Week was the first in a list of “smaller newsletters doing big things!”

I’m not a sucker for validation, but this feature means a lot for my two-month-old newsletter 🥳

Phew, this week’s stories feel like the tech version of Swizz & Timbaland’s Verzuz. First, in one finger wave, Nigeria’s government launched an onslaught against fintech platforms. Then, the FTC did a 360 on Facebook and its big tech platforms versus the Taliban – I didn’t make this up.

3 big things:

- Big tech versus the Taliban – yup, you heard that right!

- Nigeria’s government versus innovation

- FTC pulls an Oliver Twist

Should the Taliban be banned on social media?

The Short: Big Tech companies are mulling over what to do with the Taliban’s presence on their platforms, now that the Taliban is effectively the head of Afghanistan’s government.

Why it matters: If tech companies thought the hardest thing they had to contend with was de-platforming Donald Trump, they didn’t see the Taliban coming.

In a cruel twist of fate, tech companies are reckoning with the Taliban as the new head of a sovereign country. The United States refusal to designate the Taliban as a terrorist organization makes it harder for tech companies to enforce policies reserved for terrorists.

What the platforms are doing:

- Twitter: Twitter’s playing it safe and only banning content glorifying violence by the Taliban, but it is allowing Taliban affiliated pages to remain on its platform.

Facebook & YouTube: These two are facing the Taliban head-on by banning hundreds of pages representing the Taliban and content glorifying or supporting their activities.

Final thoughts: It is only a matter of time before the Taliban gains control of the Afghan government’s social media accounts, given most government officials have fled the country.

If nothing changes, big tech companies might need to come to terms with the Taliban’s new status and the need to be accorded the same treatment reserved for world leaders like President Macron and President Biden.

Lord help us.

Nigeria’s government comes for fintech platforms

The Short: Two sinister things happened this week:

- The Central Bank of Nigeria (CBN) froze the bank accounts of four fintech companies for 180 days.

- Nigeria’s Information & Technology Development Agency (NITDA) proposed ominous amendments to expand its mandate.

CBN: The CBN conjured up an ex parte motion to freeze the accounts of online wealth management platforms –Risevest, Chaka, Trove & Bamboo for:

- Operating without licenses as asset management companies.

- Using FX from the Nigerian FX market to buy foreign stocks/bonds.

- Weakening Nigeria’s Naira against the Dollar.

Fact-check:

- The Securities and Exchange Commission (SEC) granted operating licenses to the four companies as asset management platforms for trading stocks – so, yes, they do have licenses.

- Fintech is not why the Naira is weak – countless culprits, but let’s drill it down to plunging oil prices, high import costs, declining foreign reserves and domestic inflation.

What this means: CBN’s move is an indication that Nigeria’s government can make things up to pass arbitrary laws.

The CBN governor can apply for an ex parte order to deter fraudulent bank transactions, but there’s nothing fraudulent about the activities of the fintech platforms. So, what gives?

NITDA: The technology development agency does the opposite of developing technology by proposing licensing fees, a 1% profit share pre EBITDA for companies with over ₦100 million ($243,831) in revenue.

Essentially signalling to tech companies that not only will you fork over 1% of your profits, but you will also pay taxes, and if you don’t – you will be fined and, or jailed.

Behind the curtain: NITDA says these amendments are important in keeping up with the digital economy, but it’s a power play to determine what companies get licensed, revoked, suspended, or renewed – a clear departure from promoting free-market or competition.

Final thoughts: I’m not a fan of arguments that state the tech community does not engage with regulators. They do. The proposed startup bill with NITDA as a partner is an example.

To promote a thriving startup industry in Nigeria, the government needs to work with the community to build industry-led systems that support rather than harm innovative work.

The FTC refiles its antitrust complaint

The Short: The Federal Trade Commission (FTC), under the leadership of antitrust honcho Lina Khan, filed an amended complaint against Facebook to unwind its acquisition of WhatsApp and Instagram, following the dismissal of its previous complaint by a federal judge for insufficient evidence.

Key moments from my chat with Investor and International Tech Lawyer Tola Onayemi to unpack the FTC’s move:

What this means:

Tola: The biggest issues the FTC will face is proving antitrust injury when users do not pay to use Facebook and establishing a “like for like” comparison to Facebook to show anti-competitive stifling.

Facebook will claim bigger companies like Google are its competitors to reduce the impact of any claims against it. The problem is how do you decide who is actual competition when there is no exact “like for like” comparison that is well established?

Impact of the FTC’s complaint on big tech’s acquisitions:

Tola: Facebook will argue that the acquisitions were approved and the FTC is trying to change the written rules to prove a case that does not exist.

The biggest hurdle the FTC will have is that tech industry players adopt business models that are conventional to how the Sherman act was intended to operate. E.g tech services are free for the consumers, and tech companies make money through mutually beneficial partnerships – through app developers or advertising.

It is hard to pre-empt how Google & Facebook’s acquisitions will impact antitrust in the future, e.g., WhatsApp is a free service to most consumers, how do regulators determine the impact on antitrust given that Facebook is still defining its business model.

Does the FTC stand a chance?:

Tola: It seems like the FTC is throwing things against the wall and hoping something sticks. If the FTC has credible developer testimonials to prove a pattern of competition, it could stand a chance, but I think a more creative re-framing of the entire antitrust case should be the first thing. I haven’t seen that reframing properly done yet.

By the [redacted] numbers: The FTC redacted the metrics it used in its definition of “personal social networking” in the public version of its complaint, but highlighted metrics like time spent, daily active users, and monthly active users to bolster its argument about Facebook’s dominant market share.

Facebook says:

Our acquisitions of Instagram and WhatsApp were reviewed and cleared many years ago, and our platform policies were lawful.

The FTC’s claims are an effort to rewrite antitrust laws and upend settled expectations of merger review, declaring to the business community that no sale is ever final.

Final thoughts: Facebook’s pushback against the FTC is just as important as Epic’s ongoing battle with Apple over its platform policies. This is not a singular fight against one company.

The FTC’s complaint could jeopardize Silicon Valley acquisitions, not just for Facebook, but for Amazon’s acquisition of Whole Foods or Apple’s acquisition of Beats Electronics. The list is endless.

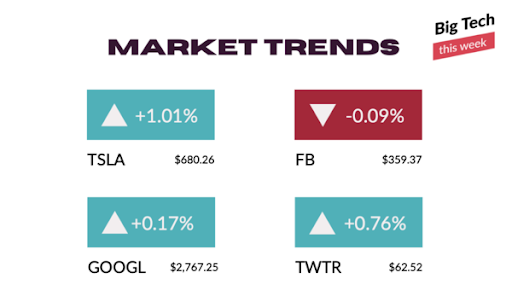

Market Trends

Market Watch: Here’s how the stocks of companies, which dominated the news this week performed as of market close:

Tesla:

- Tesla Inc. stocks rose on Friday by 1.01%, outperforming some of its competitors after CEO Elon Musk announced the company is working on a humanoid robot to be used for manufacturing or boring, repetitive tasks.

Facebook:

- The shares of Facebook Inc. slumped 0.09% on an all-around mixed trading session for the stock market, compared to competitors. The volatility comes the same week the FTC refiled its antitrust complaint and CEO Mark Zuckerberg announced its new virtual reality product Workrooms.

Google:

- Google’s parent company Alphabet Inc demonstrated a mixed performance compared to its competitors, the same week YouTube mulled over its management of Taliban content.

Twitter:

Shares of Twitter rose 0.76% higher to $62.52 but underperformed competitors like Microsoft and Alphabet Inc, the same week they applied conservative policies glorifying violence against Taliban content.

New product spotlight!

New app on the block: Facebook launched a private beta of Workrooms, enabling virtual meetings with co-workers through VR headsets.

First Impressions: As the world grapples with Zoom fatigue and remote work, building exciting products that foster closer relationships with colleagues is essential.

You can call in using webcams, be represented by an avatar, and type on virtual keyboards. You can sit in conference rooms or have standing meetings – dream up your virtual reality.

Facebook’s metaverse: The Workroom is Facebook’s first product into its metaverse ambitions – creating a digital world where people could meet and connect over work or play.

Verdict: The app is still in private beta mode, meaning only a handful of people can use it. I’m waiting on a global release to test this out with friends who own VR headsets. I’m looking out for how developers build out the app through APIs and interconnected experiences for users.

—

That’s it for the week. See you next Sunday!

Do us a solid by sharing the newsletter with your network of tech enthusiasts. Invite them to join the party 🙂