The short: In a bold move that delighted economists across the country, Nigeria’s Central Bank (CBN) granted a long-awaited demand by floating the Naira – a decision that’s had a far-reaching impact on Nigeria’s startup scene.

A month and some change: CBN’s new policy landed with a domino effect across Nigeria’s startup ecosystem, as the Naira’s value declined against benchmark currencies like the Dollar, Euro, and British pound.

Patrons of e-commerce services were forced to contend with high inflation, which made them reassess their financial priorities.

Marvin Uche, CEO of e-commerce platform Hala, acknowledged the impact of the new policy on user behaviour.

“Online spending decreased, with users ordering less. However, with the prices of goods increasing, our transaction size remained relatively the same”.

While e-commerce platforms took a hit, startups managing investment portfolios witnessed slower asset growth.

Jude Dike, Co-founder and CEO of GetEquity, an investment and fundraising platform, explained:

“The effects have been both positive and negative. Some individuals mitigate risks associated with Naira investments by converting them into foreign currencies. However, the economic downturn has reduced investments and deal sizes, as people have limited discretionary income.”

Ripple Effect: The Naira float wasn’t the only rollout in the CBN’s hat. They reintroduced Naira remittance from the diaspora, restoring liquidity to the banks. Pre-reintroduction, people in the diaspora could only send dollars to domiciliary accounts since the CBN halted Naira payments to Nigerian accounts. You could only pay for online services like Netflix with international or virtual cards.

To plug this gap, startups offered virtual card services for online payments. But, with the Naira remittance pay-out policy, startups with business models centred around virtual cards must pivot to alternative flagship products to keep the lights on.

Final Thoughts: Policies come with a mixed bag of outcomes. For some startups, the policy’s been a revenue boost – for others – it’s back to the drawing board. As Nigeria’s startup ecosystem grapples with the complexities of a regulatory landscape, industry analysts are confident this will be a temporary shock. But, the economy will be better for it.

Jumia Heist!

The short: Jumia Kenya, part of the formidable Jumia Technologies AG trading group, seemed like an impenetrable fortress of e-commerce greatness. But a cunning employee was caught red-handed, swiping a whopping $150k (a cool KES 21.2 million) from the company’s piggy bank! Talk about an audacious heist!

Picture this: The employee manipulated vendor payment entries, cunningly diverting those Kenyan shillings to their accounts.

Here’s the real kicker: Jumia Technologies AG admits that its business is like a labyrinth, with millions of users and a complex system that makes it hard to spot alleged con artists. But let’s be honest, who would’ve thought their grifter would emerge right from within the ranks?

Still standing: While the loss didn’t bring Jumia to its knees, they’re sounding the alarm bells and warning us all about the threat insider heists pose for the future.

Jumia is not alone in this fiasco. Kenya’s fraud problem is on the rise. Safaricom, ever the trendsetter, had to bid 33 employees farewell for their sticky fingers in the fiscal year ending March 2023.

Here’s the grand finale: Insider fraud is bad for business. It might seem like a cheeky prank at first, but it could snowball into a nightmare for companies like Jumia, who still struggle to find their path to profitability.

Final thoughts: The heist-man revealed the cracks in Jumia’s system and became a cautionary tale for startups across Africa.

I learnt from some founders that this incident made them do a double-take on their security systems to plug potential holes. There’s never been a better time to re-up internal security systems as startups increasingly become targets for sophisticated cyber-criminals.

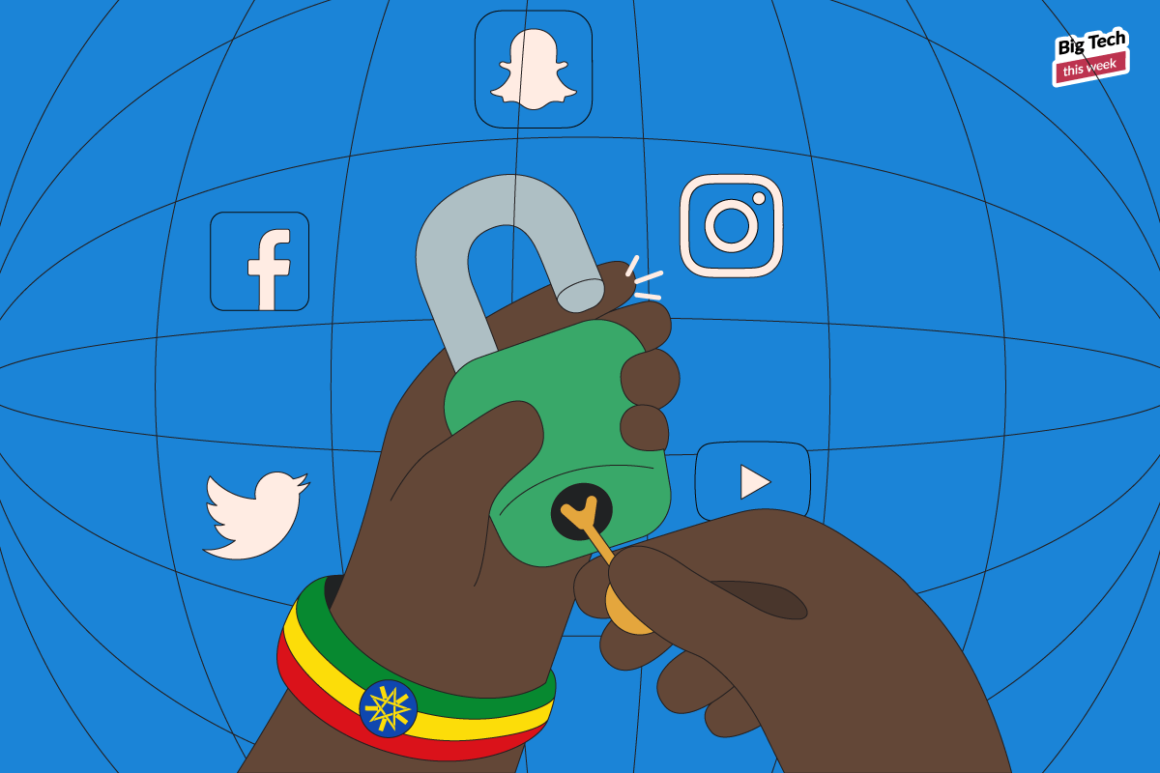

Ethiopia’s internet era

The short: Ethiopia lifted the veil of its social media ban that kept its citizens from accessing the internet.

After what seemed like an eternity, the Ethiopian government unblocked social media access to citizens.

The lifting of the social media ban marks a turning point in Ethiopia’s digital landscape following the government’s internet restriction on February 9th.

Costly bans: Human Rights huncho Amnesty International condemned the government’s ban stating it violated citizens’ rights to freedom of expression and access to information. Ethiopia’s Center for Advancement of Rights and Democracy (CARD) revealed that Ethiopia’s economy lost more than $140 million in internal revenue thanks to the ban. Costly!

Final thoughts: Communication cuts are frequent in Ethiopia, but the Tigray region’s blackout lasted two years, costing citizens critical access to families across Ethiopia. Internet access tends to be collateral damage during internal conflicts. African leaders must get creative about managing conflicts without robbing citizens of the right to connect with the world.

Thanks for reading! We’d love to hear your thoughts about this week’s issue.

Please respond directly to this email or find me on Twitter @fatuogwuche 🙂

And follow us on Twitter @bigtechthisweek