Top of mind. Happy Sunday!

I have a question to ask you, and I’d love your feedback. I experimented with the last two issues to gauge the time of day you enjoy receiving the newsletter and discovered you are an evening owl – with a preference for late evenings than midday.

I picture you reading the newsletter while enjoying a relaxing evening, with a special kind of beverage 👀 (not judging).

If I’m right about this, would you please respond to the newsletter by replying to this email, and I’ll adjust future drop times to fit in nicely with your day. Thank you!

3 big things:

- Francophone bags its first unicorn

- Apple’s App Store powers are decreasing

- Stripe might IPO soon

Francophone Africa bags its first $1.7 billion unicorn

The Short: Senegal-based fintech company Wave bagged itself a new title as the latest unicorn (startups valued above $1 billion) out of Africa by raising $200 million at $1.7 billion valuation, with big name backers like Sequoia, Stripe, Founders Fund, etc.

How Wave works: Wave is one of the few fintech companies in Africa operating a hybrid online and offline model. With a QR-card, you can deposit and withdraw money through the agent network for non-smartphone users, and smartphone users can do the same through the mobile app.

By the numbers: Wave has 5 million+ downloads on Google’s PlayStore and currently powers about 4 million active users in Senegal, processing billions of dollars in annual transactions with a growing market in Côte d’Ivoire.

Why it matters: Wave is the first startup in Africa to become a unicorn in Series A. Notable startups like Flutterwave and Opay became unicorns in Series C funding round. Wave is leading the next wave of unicorns outside West and North Africa.

Big Picture: Wave was spun off of Sendwave, a Y Combinator-backed company acquired by WorldRemit in 2020. Sendwave’s history of institutional investors and Wave’s market validation, accelerated the trajectory of Wave to unicorn status.

Petty competitors: Orange is Senegal’s biggest mobile operator with a 50% market share. Wave rode in on a golden chariot to save distressed users, offering a better service and 70% less in transaction fees.

…there’s more: Sensing great competition, Orange halted the purchase of its airtime on Wave’s mobile app, leading Wave to respond by engaging the Regulatory Authority for Telecommunications and Post (RATP). The case is pending.

Final thoughts: The trajectory to unicorn status is getting faster everyday. Where it once took Interswitch 17 years, we see more companies achieve this in less time.

This signals to the world that African companies are building valuable products with real market need. It’s splendid for the success of the industry and validation for founders toiling behind computer screens to build products that change the world.

The court clips Apple’s App Store powers

The Short: After an epic battle (all pun intended) between Apple and Epic – makers of video game Fortnite, the court ruled that Apple must allow other forms of in-app purchases on the App Store.

Why it matters: This doesn’t mean Epic won the suit, but one of Epic’s prayer was for developers to be allowed to offer cheaper payment options to customers outside the App Store.

What changed: Prior to this ruling, Apple only allowed its payment system for in-app purchases on the App Store, to retain a 30% cut of goods and services. This means, if you download an app from the store and buy anything within that app, Apple takes 30% from the app developer.

Until Epic… Epic’s CEO Tim Sweeney publicly criticised Apple for its monopolistic practices and the 30% cut, which he claims negatively impacts app developers.

Sweeney challenged Apple by putting an alternative payment method with the last update of Fortnite; Apple took the bait and responded by kicking Fortnite out of the App Store. Epic sued Apple.

Judge ruled in no one’s favour: There could be no better arbiter of this trial than Judge Yvonne Gonzalez Rogers, a charismatic antitrust Judge. She challenged Apple, called out Epic, and ultimately ensured both companies got the tough end of the stick.

Judge Rogers criticised Epic for baiting Apple and concluded they violated the App Store policies and would have to pay Apple its 30% cut.

And for Apple, they are:

Permanently restrained and enjoined from prohibiting developers from including in their apps and their metadata buttons, external links, or other calls to action that direct customers to purchasing mechanisms, in addition to In-App Purchasing and communicating with customers through points of contact obtained voluntarily from customers through account registration within the app.

Unless a higher court upturns this, Apple must allow developers to direct users to other payment options beyond its own system. HUGE!

Final thougts: I’m an ‘Appler’ for life – if we Apple fans even have a name. But it’s about time Apple met a bigger bully. This time, the court was the answer.

The court’s unprecedented ruling accusing Apple of engaging in anti-competitive behaviour by preventing users from getting cheaper payment options opens up a new world of revenue for app developers.

It’s a new dawn with decentralized financing. No one company should have all that power.

Stripe is about to shake up the tech industry

The Short: Digital payments company Stripe is in talks with investment banks about an Initial Public Offering (IPO) in 2022.

What this means: Stripe’s play for an IPO is a long-awaited dream in Silicon Valley circles. The 11-year-old company is already valued at nearly $100 billion, pitting it alongside uber-successful companies like TikTok.

Big picture: Stripe will not issue new shares to raise capital, but will do its IPO via a direct listing. This means current investors can sell their shares in the stock market. Stripe won’t pay a ton of money to investment bankers during this process, and less engagement with intermediaries.

Notable companies that have taken this route are Spotify and recently, Coinbase.

Final thoughts: Stripe serves as a blueprint for a crop of new fintech companies around the world. Companies like Paystack, which got acquired by Stripe, styles itself as “the Stripe of Africa”.

Stripe’s IPO will be a tremendous win for the industry and money maker for early investors. It’s no wonder everyone has eyes on this.

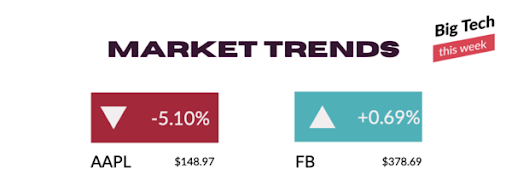

Market Trends

Market Watch: Here’s how the stocks of companies, which dominated the news this week performed as of market close:

Apple (Ticker symbol: AAPL)

- Apple shares bottomed out at -5.10% following the court’s ruling on the Epic case, making this its biggest one-day drop in 4 months.

Facebook (Ticker symbol: FB)

- Facebook shares continues to soar week-over-week with a 0.69% increase following the well-received launch of its smart glasses in partnership with Ray-Ban.

New product spotlight!

New product on the block: Facebook partnered with Ray-Ban to launch the next generation of smart glasses called Ray-Ban Stories! The glasses retail at $299 and can be bought anywhere Ray-Bans are sold.

First Impressions: Aesthetically, the smart glasses are sleeker than other smart glasses that have come before it, like Snapchat’s Spectacles and Google Glass (RIP 👀).

Features:

- 6 hour battery life (with intermittent use)

- Dual-5 megapixel cameras

- Two front-facing cameras to capture videos and photos

- Standalone camera app called Facebook view for editing and sharing

- Voice assistant

- Speakers on both sides of the frames to listen to podcasts or take a phone call

- Battery powered glasses case with a usb-port

Verdict: I ordered this the moment it launched. The smart glasses are not AR powered, but I’ve heard it’s on the roadmap. Privacy analysts have raised concerns but it seems people are willing to sacrifice privacy on the altar of new technology.

I can’t wait to get my hands on these. I reckon it will be a popular gift item as we enter the holiday season.

—

That’s it for the week. See you next Sunday!

Please do us a solid by sharing the newsletter with your network of tech enthusiasts. Invite them to join the party 🙂