Top of Mind. Happy Sunday!

It’s the last newsletter of 2021, and we are sharing our verdict on the biggest moments in African tech this year. 2022’s newsletter will debut January 9th 🙂

Five startups attained unicorn status ($1bn+ valuations). Women are winning with more funding opportunities, and a Nigerian woman founder capped the year by securing a major exit. An Egyptian startup got listed on Nasdaq.

A. Lot. Happened. Let’s get into it.

3 big things:

- The biggest moments in African Tech

- Behind the scenes of Flutterwave x Wizkid’s partnership

- Jack Dorsey appoints 3 Nigerians to Bitcoin Trust Board

Biggest moments in African tech

Toplines: There were significant locally-led acquisitions and venture funding that signalled a growing ecosystem. However, African innovators still had to contend with crippling regulations, including internet bans and other restrictions on FinTech and cryptocurrency.

A rundown of significant milestones:

January: Africa’s female-first venture capital fund FirstCheck launched in January. The fund aims to invest “ridiculously early” in women-led and women-focused funds in Africa.

February: Nigeria’s central bank “banned” cryptocurrency. The banking regulator instructed financial institutions to cease the facilitation of crypto-related transactions and immediately close accounts found dealing with crypto.

March: Flutterwave was first to attain unicorn status in 2021, with a valuation of $1bn in its $170m Series C round.

April: Ghana became home to Twitter’s headquarters in Africa. Nigerians felt entitled, but according to the company’s team’s statement, Ghana stood out for its support for “free speech, online freedom, and the Open Internet”. Good call, Jack.

May: It was an Egyptian spring for the startup capital scene. Sawari Ventures closed its $71 million fund, and accelerator Flat6Labs closed its early-stage startup fund at $13.2 million (four times its original target). Another VC, Algebra Ventures, launched a second fund with a $90 million mark.

June: The Nigerian government “indefinitely suspended” Twitter. Hello VPN.

July: Egyptian transport startup Swvl announced its merger with US Special Purpose Acquisition Company, Queen’s Gambit Growth Capital, to list Nasdaq. The transaction valued the company at $1.5bn.

August: Pleasant August surprise as SoftBank made its first bet in an African startup – leading OPay’s $400m funding round at a valuation of $2billion. Remarkably, this fundraising raised the big question; what makes a startup African?

September: It was a September to remember. Two African unicorns were born. French-speaking Africa got its first unicorn through Wave’s $200M Series A investment led by Founders Fund, Stripe, Ribbit, and Sequoia Heritage. Second, west African tech talent accelerator Andela raised $200m in its Series E funding round at a valuation of $1.5bn.

October: Google announced plans to invest $1bn in Africa’s digital transformation over the next five years. The commitment includes an Africa Investment Fund that will provide equity-free capital investments and assistance to startups on the continent.

Side note: The Nigerian government launched “eNaira”, a mobile money transfer App built on blockchain technology.

November: We witnessed the announcement of Africa’s fifth unicorn in 2021. The Jeff Bezos backed cross-border payments company Chipper Cash raised $150 million at a $2 billion valuation (its second raise within the year). Cryptocurrency exchange FTX led the round.

In other crypto-related news, Nigerian-American pop star Davido teamed up with Bitsika to announce the launch of $Echoke, a social crypto token.

December: A woman-founded company and West Africa’s first privately-owned submarine communications cable, MainOne, was acquired by Equinix, a California-based telecommunications company, for $320 million.

Funke Opeke owns it. Remember her name.

Bonus: Nigerian VC firm Ventures Platform raised a $40m startup fund this December, but that’s not the news. All of you are getting accustomed to triple-digit raises. The word is that Nigeria’s Sovereign Investment Authority (a government-managed sovereign wealth fund) led the funding round.

Knowing how risk-averse these institutions are, it is safe to say that the move is a significant vote of confidence on the continent’s startup scene. Long may this continue. Fatu’s Big Prediction: I am betting that a Nigerian tech startup will go public in 2022.

BTS: Wizkid’s collaboration with Flutterwave $end

The short: Leading payments processing startup, Flutterwave announced Wizkid, Nigerian Grammy-award winning pop star, as the company’s global ambassador. The announcement unveiled a new product, Send “$end” – “remittance solution, aimed to increase remittance flow and uptake” for Africans. Watch the announcement video here.

How it happened: During a North American tour for his Made in Lagos album, September, WizKid made a quick stop in Beverly Hills, California, to film the commercial and other content for the $end rollout – including a yet-to-be-released interview featuring Wizkid and Olugbenga Agboola “GB”, the CEO of Flutterwave.

Why it matters: $end is Flutterwave’s most ambitious product yet. The company has become the leading payments infrastructure backbone on the continent, and $end is a global push to facilitate payments to Africa worldwide.

Between the lines: Wizkid and Flutterwave are on both sides of the same coin. Wizkid represents an African-made product that has earned global acceptance. Flutterwave shares the same vision to scale its infrastructure for international payments.

Goals:

Africa to the World, the World to Africa, making payments simple. [Like] you have made music simple said GB to Wizkid, during one of the unreleased recordings previewed by BigTechThisWeek.

Final thoughts: $end is a game-changer. I am already signed up and can’t wait to make my first remittance through the App.

Africa needs a working payment solution that integrates the continent and bridges the barriers that hinder integrations with the rest of the world. Flutterwave has the capabilities to make it work. The more significant push is to get the world to trust and embrace it. This challenge is what makes WizKid the ideal partner.

Jack Dorsey’s Bitcoin Trust board is a Nigerian supermajority

The Short: In February 2021, Twitter founder Jack Dorsey announced the Bitcoin Trust (BTrust) with African American rap mogul Jay Z and a 500 BTC joint endowment to expand the adoption of Bitcoin in Africa and India.

Why it matters: The overwhelming Nigerian representation on BTrust’s board reflects Jack’s overall bullishness on Nigeria. Nigeria’s dominance in the bitcoin landscape transcends the continent. According to a survey by Statista in 2020, Nigeria comes third in trading volume globally, only surpassed by the US and Russia.

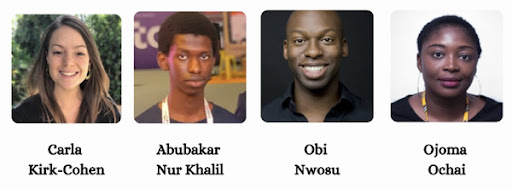

Meet the board:

- 3 Nigerians: Ojoma Ochai, Managing Partner Co-Creation Hub (CCHub); Obi Nwosu, Co-founder Coin Floor; and Abubakar Nur Khalil, CTO Recursive Capital and Bitcoin Core Contributor.

- +1 South African: Kirk-Cohen, Software Engineer at Lightning Labs.

Watch out: Nigeria, South Africa, and India regulators are not crypto-friendly. For BTrust, this represents a significant opportunity.

- India outrightly banned crypto use in 2018, but this was quashed by the country’s Supreme Court this year.

- In Nigeria and South Africa, governments have imposed restrictions that threaten adoption. For example, South Africa is changing the rules to prevent pension funds from holding crypto, while Nigeria’s central bank instructed banks to close accounts of customers dealing in crypto.

- Per Adewunmi Emoruwa, Lead Strategist at Gatefield, an Abuja-based public policy consultancy:

“BTrust board would need to develop an engagement strategy targeting regulators. A less restrictive policy environment will accelerate mainstream adoption. Playing up the utility of crypto and its wider economic benefits could potentially douse regulators’ concerns over its speculative attributes.”

Final thoughts: The board composition is impressive (I particularly love the 50:50 gender mix). Knowing that they will run the board independently gives me more confidence in this team getting the job done.

That said, Jack still needs to explain why the BTrust is overwhelmingly Nigerian to the rest of Africa.

Have a fantastic holiday season! See you in 2022 🎉🥳

I can’t wait to reconnect in 2022. Enjoy family, take care of your mind, body, and spirit. See you soon!